# David Hall

Advertisement

All time

ICHH wind down

Dublin homeless charity to be liquidated following sexual assault allegations

1 Nov 2021

35.5k

Vulture funds

Concerns over letters sent to mortgage-holders demanding full payment of arrears within 30 days

13 Apr 2019

117k

111

mortgage to rent

'I can sleep at night now': iCare buys 19 homes to save families from eviction

17 Jan 2019

27.7k

39

Great Irish Sell Off

No vulture fund or bank has ever been sanctioned for breaching the code of conduct

24 Nov 2018

12.5k

30

Mortgage Arrears

Central Bank to track a 'critical mass' of restructured mortgages that are due to come up for review

13 Nov 2018

14.2k

28

Arrears

Ulster Bank sold mortgages to vulture fund despite offer to buy loans for mortgage to rent

31 Aug 2018

24.3k

38

sell off

'Where's Paschal?': Calls for political leadership as PTSB mortgage sale to vulture fund to proceed

8 Aug 2018

19.4k

69

mortgage scandal

'Bizarre carry-on': Criticism of consumer expert who said tracker victims should have faced tougher questioning

20 May 2018

24.1k

32

Mortgage Arrears

'This is a human crisis': David Hall believes 17,000 families will have homes repossessed

17 May 2018

14.8k

34

Repossession

Mother-of-two 'refusing food' after being jailed for contempt of court

10 May 2018

40.2k

Mortgage distress

'They're refusing to engage': Banks reject almost half of personal insolvency proposals

25 Oct 2017

14.6k

53

mortgage to rent

A new scheme will allow mortgage holders in long-term arrears to stay in their homes

27 Sep 2017

19.4k

92

RIP

'She was inspirational" - a Kerry woman whose life assurance lapsed over arrears of €244 has died

14 Jul 2015

48.8k

21

have a heart

A bank tried to evict a hospitalised mother and her daughter this week

28 Jun 2015

51.1k

fuzzy logic

It's costing banks €100,000 a go to reject insolvency applications...

14 Apr 2015

11.0k

15

Repossessions

'The banks weren't showing compassion, they were waiting for an increase in property prices'

9 Mar 2015

15.5k

97

Arrears

'The entire system is rubbish': Just 40 houses bought through mortgage-to-rent scheme

28 Jun 2014

11.9k

11

subprime mortgages

'Again consumers lose out and the banks win' - PTSB to sell mortgage loan books

24 Jun 2014

16.6k

70

Hardball

Stop paying your mortgage. Don't leave your home - new advice from the IMHO

17 Jun 2014

33.1k

174

Water protests

One arrested as angry protesters confront Taoiseach at elderly-care centre

12 Jun 2014

16.3k

133

THE WINNER TAKES IT ALL

Confirmed: The Socialist Party takes a second Dáil seat in Dublin West

25 May 2014

70.8k

201

Dublin West

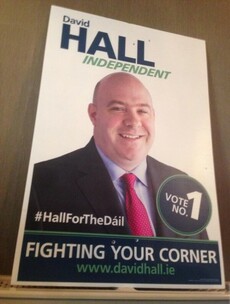

David Hall insists he's finished with Fianna Fáil as he launches by-election bid

2 May 2014

11.8k

29

CONFIRMED

Mortgage campaigner David Hall is going to run in the Dublin West by-election

25 Apr 2014

7.8k

44