# Mortgage Arrears

Advertisement

All time

Mortgages

Doherty condemns AIB use of non-disclosure agreement for mortgage deals

9 Mar 2013

13.1k

34

Good Morning

The 9 at 9

Good morning. Here are nine things to know as you start your day.

8 Mar 2013

8.0k

14

Mortgage Arrears

AIB commits to working out deals for mortgage holders in arrears

19 Feb 2013

4.1k

31

Good Morning

The 9 at 9

Good morning. Here are nine things to know as you start your day.

19 Feb 2013

9.2k

8

Leaders' Questions

Personal insolvency agency to open 'early in the summer' - Taoiseach

13 Feb 2013

6.4k

59

Debt

Department of Finance head: Debt should be written off for those who really can't pay

16 Oct 2012

7.8k

98

Good Morning

The 9 at 9

Good morning! Here are nine things you should know as you start your day…

20 Sep 2012

7.5k

9

Voices

Column: Pretending this mortgage crisis isn't happening won't make it go away

Noeline Blackwell

24 Aug 2012

86

41

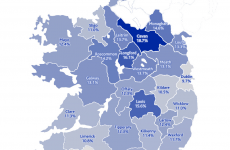

Mortgage Arrears

10 per cent of Irish mortgages are in arrears says Central Bank

25 May 2012

2.0k

35

Good Morning

The 9 at 9

Nine things to know this morning, including: more garda station closures, seven killed in US college shootings, and a new ‘flying car’ (video).

3 Apr 2012

5.0k

2

Arrears

There is 'no silver bullet' to address mortgage arrears, says financial regulator

2 Mar 2012

3.1k

23

Mortgages

Government's new debt regime may allow mortgage debt to be written off

25 Jan 2012

4.7k

23

Your Say

Poll: If you were/are in mortgage arrears would you be in favour of renting your home?

13 Oct 2011

2.2k

36

Debt forgiveness

Burton calls on banks to do more for struggling mortgage holders

28 Aug 2011

621

28

Voices

Column: Self-employed people are the recession’s real victims

Brendan Dempsey

27 Aug 2011

169

100